End-to-end overseas courier services in the Philippines

Parcel Pickups

After scheduling parcel pickup from the point of origin, our Ninja will collect and send them to one of our local warehouses for palletizing, sorting, and picking.

.webp)

Middle Mile

Your parcels will depart by air freight, sea freight, or trucking, depending on the service lane to the destination country. Ninja Van will handle all export and import customs clearance for you.

Last Mile Delivery

After clearing customs, parcels are loaded and prepared for delivery to your customer’s doorstep. Our team of last mile experts will map out the most efficient route for your parcels.

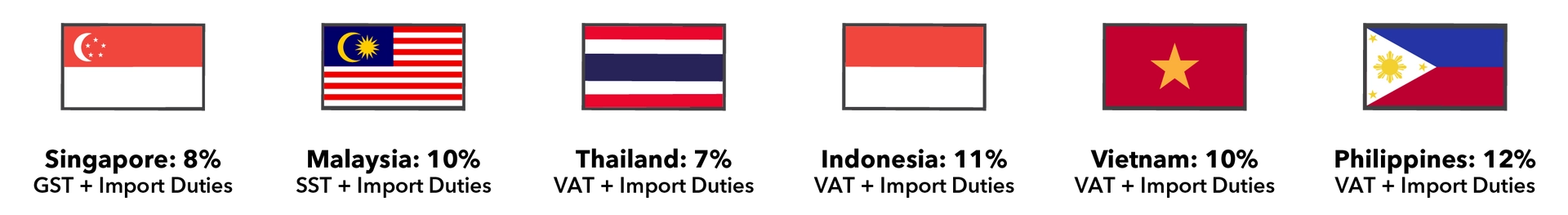

Taxes for international shipments

*Import duties are subjected to destination country regulations and are also dependent on commodity type.

What our shippers are saying

Notice

Official notice: Changes to Singapore Custom Regulations - GST on Imported Low Value Goods (LVG). We would like to inform you of the following changes by the Inland Revenue Authority of Singapore (IRAS), effective from 1st January 2023:

The New Overseas Vendor Registration (OVR) Regime

Under OVR regime, any supplier belonging outside Singapore are liable for registration, under either retrospective or prospective basis if:

They have an annual global turnover exceeding S$1 million; and

Makes B2C supplies of Low Value Goods (LVG) & remote services (both digital and non-digital) to customers in Singapore exceeding S$100,000 annually

Retrospective Basis:

Global turnover & value of B2C supplies of LVG to Singapore exceed S$1 million and S$100,000 for the calendar year (1 Jan - 31 Dec)

Prospective Basis:

Supplier reasonably expect the value of global turnover and B2C supplies of LVG to exceed S$1 million and S$100,000 for the next 12 months

These eligible suppliers are mandated to:

- Be GST registered in Singapore once eligible (application can be done via this link)

- Charge 8% GST to SG customers at point of sale for LVG (<S$400), imported via air or post

Notice FAQs

What do you need to do if you're an OVR seller shipping to Singapore?

Please ensure you provide the following information to your logistic provider upon order creation to ensure smooth customs clearance:

- GST Registration Number issued by IRAS upon effective date of registration

- Value of each item in the parcel

- Indication of whether GST has been paid for each item (Y/N)

How does this affect me as a consumer?

From 1st January 2023, if you are a consumer in Singapore, you will be charged GST by sellers on goods valued at S$400 or below (“Low Value Goods”), which are imported into Singapore via air or post and purchased from GST-registered suppliers.

The sales tax is charged on the value of LVG including the following;

- Transportation and insurance costs

This OVR Regime will not affect purchases from:

- LVG from Non-OVR registered sellers; or

- Imported via sea or land (regardless of value); or

- Imported via air or post (valued above $400).

For further information, please refer to the official IRAS website or contact your Ninja Van Account Manager

Other Services

.webp)

Fulfillment & Warehousing

Our fulfillment and warehousing services give you operational efficiency and reduced cost while having full visibility of your inventory’s movement.

Learn more

.webp)

Sourcing & Procurement

Source all your products at competitive rates and get them delivered to you or your customers with just a click. Our procurement team specializes in sourcing and buying from China and SEA.

Learn more

.webp)